Photo courtesy of Andy Semple and Steve Hunter.

GREEN ENERGY CHRONICLES

John's newest update on graft, corruption and waste in the CLEAN energy sector.

Senate white paper says carbon tax an option

A Senate Finance Committee white paper on possible federal tax code changes for energy suggested establishing a carbon tax in place of most or all energy tax incentives. The paper offered the carbon tax with a range of other policy options to help chip away at a Congressional Budget Office-estimated $16 billion of foregone energy-related tax expenditures in fiscal 2013.

The paper, released Thursday, came with the disclaimer that the policy suggestions “do not necessarily have the endorsement” of committee Chairman Max Baucus (D-Mont.) or ranking member Sen. Orrin Hatch (R-Utah). Baucus said he would pour his efforts into overhauling the federal tax code when he announced Tuesday that he wasn’t seeking reelection in 2014.

The five circles of carbon tax hell

The carbon tax, a serious proposal supported by some thoughtful people, deserves careful consideration. This tax is the subject of an extensive and often technical literature with top scholars making proposals for Resources for the Future and for the Brookings Institution. The term “carbon tax,” however, has a chameleon-like quality, meaning something different in each of three different contexts.

In the context of economic theory, the carbon tax is a way to deal with an imperfection in the energy market. In this world, carbon dioxide (CO2) emissions cause harm for which the emitter does not pay. The purpose of the tax is to impose the full cost of his activities onto the user of carbon-based fuel, so as to force him to incorporate the cost of the harm into the price of the fuel. Once the level of harm and its costs are included in market prices, then the energy market will work properly.

In this formulation there is no preconception about the proper level of the tax or the final outcome of the competition between sources of energy. The tax is set by careful assessment of the costs of the harm caused by the emissions, and the level of use of carbon fuels is then determined by market prices.

In the context of tax theory and government finance, the carbon tax has a different function. It is a way to finance government and replace other levies. In this world, the goals are to maintain economic efficiency and tax equity, while, as in any tax system, plucking the most feathers from the geese that squawk the least.

In the context of environmentalism, a carbon tax can reduce emissions of the “pollutant” CO2. In this world, the limitations, caveats, and subtleties of the contexts of economic purity or tax policy do not apply. The reduction targets are not limited by any empirical estimate of the harm caused by CO2 — or by any concern that the level of a tax might rise so far as to become economically destructive.

California and Quebec link cap and trade programs (May 2012)

It’s good news for proponents of cap-and-trade programs. The California Air Resources Board (CARB) announced last week that California’s cap-and-trade program will be linked to Québec’s cap-and-trade program. CARB recently released proposed regulations to link the two programs, and a 45-day public comment period started following the announcement. CARB will consider the proposed regulations at a meeting on June 28, 2012. The proposed regulations ensure that California and Québec permits are interchangeable at auction. The first linked auction is scheduled for November 14, 2012.

California adopted its cap-and-trade program in 2010, and designed it to link to other programs. The program is part of its Global Warming Solutions Act of 2006, or AB 32. It covers major sources of greenhouse (GHG) emissions, according to CARB’s website, which include refineries, power plants, industrial facilities and transportation fuels. The program’s enforceable GHG cap will decline over time. CARB will distribute allowances, or tradeable permits, that will be equal to the emissions allowed under the cap. The program’s target is to reduce emissions to 1990 levels by 2020.

Billionaire to focus on cap and trade, climate issues

President Obama was hosted in San Francisco Wednesday night at the spectacular mansion-with-a-Pacific Ocean-view of private equity billionaire Tom Steyer, the scion of a wealthy New York family (say, isn’t this the guy Obama beat in the fall election?). Their goal? Raise money for the Democratic Congressional Campaign Committee to help restore California’s Nancy Pelosi – also in attendance – as speaker in 2014.

“I think Mitt Romney and I share the same income bracket,” said Steyer, a passionate member of the Green Church, at last year’s Democratic Convention. “But the reason I’m here tonight is that Mitt Romney and I don’t share the same vision for the future, especially when it comes to energy. Thanks to President Obama, America is laying the foundation for the way we power tomorrow. So here’s my question for you: Should we go back to the boom-and-bust, ‘drill-baby-drill,’ polluting energy policies of yesterday, or should we embrace an advanced energy economy that meets opportunity with innovation? ”

[Note from John: Obviously the latter. Why? Because green start-up businesses are where Steyer’s green venture capital firm has put its money. Renewable energy investor Greener Capital is the name, and rent-seeking is the game. More here, here and here.]

The end of the EU cap and trade affair

For some time, a divorce has been on the horizon. For years these sweethearts have soaked up the limelight on the international stage, but the sordid reality has sunk in. On Tuesday, a vote in the European Parliament confirmed that the love affair between the European Union and its climate policy may be well and truly over. This could turn out to be very good news for the world's climate.

The EU's cap-and-trade system is the main plank in its approach to dealing with greenhouse gas emissions and has inspired policy makers from California to Canberra. But while it's come at a high cost, it has done almost no good.

The European Commission and green groups have tried fervently to save the system, most recently with a proposal (voted down last week in the parliament, by 334 to 315) to jack up the price of carbon by postponing, and most likely cancelling, emission permits. The good news is that last week's failure could herald a global move towards smarter, cheaper solutions.

For the last couple of years, the EU Emissions Trading System has been in the doldrums. From a peak price of more than $40 per ton of CO2 in 2008, the price of EU carbon permits dropped to $20 at the onset of the financial crisis and has now slid to less than $5, trivializing the system.

All you need to know about Renewable Energy Credits (REC's)

The government has created a market in “Renewable Energy Certificates,” also known as a “Renewable Energy Credit.” RECs are yet another way that renewable energy sources take advantage of the public’s good graces, and the propensity for some politicians to be fooled into creative ways to burden unsuspecting citizens.

As far as RECs have a public purpose, two fundamental questions are:

1) Do RECs pay for the generation of new renewable energy as claimed?

2) Do RECs offset fossil fuels as claimed?

Background

RECs are sold in two primary markets:

1) some of the states that have RPSs (Renewable Portfolio Standards) allow part of the renewable mandate to be satisfied by the utility company purchasing RECs (instead of actually buying renewable energy electricity), and

2) businesses and individuals purchase RECs for perceived public relations benefits, or to ameliorate their conscience.

The problems are that these are completely artificial “credits,” based on flawed assumptions, and often misleadingly marketed. This can be best understood by working through an example.

Wind Power Example

Here are the basics, using wind as an example. The example is from a utility company perspective using my home state of North Carolina since ithas an RPS that allows RECs to be purchased by utility companies to satisfy some of the RPS mandate. But essentially, the same realities exist for RECs sold directly to consumers and businesses… 1 REC = 1 MWH (Megawatt Hour) of renewable electricity produced… The example below could use an in-state facility as well, but the out-of-state situation is easier to understand.

Lawmakers float renewable energy finance bill

A bipartisan, bicameral group of lawmakers revived legislation Wednesday that aims to spur renewable energy investment through a federal tax code tweak. Lawmakers unveiled the Master Limited Partnerships Parity Act — spearheaded in the Senate by Sens. Chris Coons (D-Del.) and Jerry Moran (R-Kan.), and in the House by Reps. Ted Poe (R-Texas) and Mike Thompson (D-Calif.) — during a Wednesday news conference. The bill would extend master limited partnerships to renewable energy projects ranging from wind power to energy efficiency. Currently, only oil-and-gas projects can use the financing mechanism.

[Note: how many times do I have to write about these guys...]

Carbon market Australia/New Zealand (PDF)

Here is a quote from a rather astute researcher...

"... because the finance guys have got it all set up and the government bureaucrats have “seen the light”, including forcing companies to buy offsetting domestic carbon credits at a much higher price than the international market. Australia is doing that now with A$23 per tonne versus Euro 2.50 per tonne on the Euro market and New Zealand looks like it is about to follow. Once Obama introduces a carbon tax, its done. Only major electoral changes across the OECD countries could reverse it. The fact that it is a scam is probably a moot point now. It's a bit like the introduction of Income Tax in WW1 to fund the imperial wars, on the recommendation of banks to western governments.”

Blythe Masters - Queen Bee of Carbon Tax

Carbon has worst quarter since 2011

Europe’s emissions market is likely to be left all but broken should the region’s parliament fail to agree next month on combating the surplus of carbon permits, after the biggest quarterly slide in prices since 2011.

Allowances, which have plunged 28 percent this year to 4.81 euros ($6.20) a metric ton, will average 5 euros in 2013, according to the median forecast of five analysts surveyed by Bloomberg this week. Prices will probably drop below 2 euros if the European Union doesn’t enact a November plan to delay the sale of some emission rights, according to UBS AG.

The euro area’s second recession since 2008 has cut demand for permits, exacerbating a glut that drove prices in the world’s biggest greenhouse-gas market to a record low in January. Europe’s parliament votes April 16 on the first part of plan by the region’s regulator to support prices by withholding some allowances over the next three years and releasing, or backloading, them into the market at the end of the decade.

B.C. auditor general slams carbon offsets

B.C.'s Auditor General John Doyle has issued a scathing report on the provincial government's efforts to be carbon neutral, saying efforts to buy carbon offsets to counter its greenhouse gas emissions are not "credible." Doyle says despite its claims to the contrary, the B.C. government is not meeting its legislated objective to be carbon neutral.

The biggest concern to Doyle is that tens of millions of dollars that are being collected each year from schools, hospitals and other public sector bodies to buy carbon offsets are not being credibly spent.

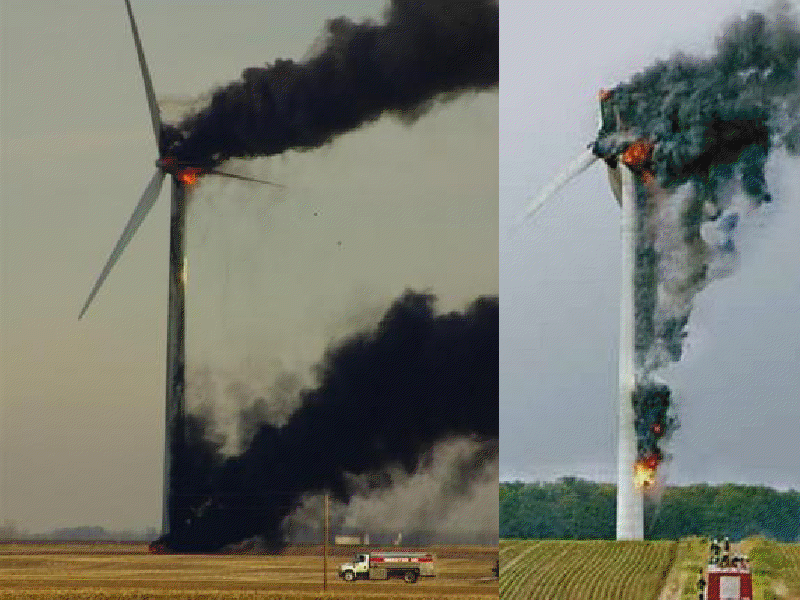

$4 million wind turbine fire in Maine wilderness area

A fire destroyed a multimillion-dollar wind turbine at the Kibby Mountain wind farm in northern Franklin County, which has generated concern about the safety and reliability of turbines, and the process by which these fires are reported to government officials and the public. Companies that operate wind farms in Maine are not currently required to report turbine fires to any state agency.

TransCanada, the Calgary-based energy company that built the 44-turbine Kibby Mountain wind farm in 2010, confirmed for the Bangor Daily News that a fire in the early morning hours of Jan. 16 destroyed one of its wind turbines -- primarily the nacelle, which is the rectangular structure behind the blades that holds the gearbox and electrical components. With the capacity to generate 132 megawatts of electricity, Kibby Mountain is the largest wind farm in New England. (TransCanada is also the company behind the controversial Keystone XL Pipeline proposal.)

The fire's aftermath troubles Bob Weingarten, president of the Friends of the Boundary Mountains, an organization that has fought against the Kibby Mountain project since the beginning. He calls the company's handling of the event a "cover-up" and believes there should be an official notification system to inform all stakeholders, including the public, when such an incident occurs.

TransCanada wouldn't reveal the cost of the damage, but Veers estimates that a single turbine costs in the vicinity of $4 million. "These are capital-intensive investments," Veers said. "You pay for everything upfront except for minor maintenance costs and expect to get revenue to pay for that over 20 years, so the loss of a turbine is a big deal for the industry."

There are no incident reporting requirements for wind farm operators, so no reliable data exist on just how rare these fires are or what causes them, Veers said. He believes the most likely causes of turbine fires are lightning strikes and electrical shorts, but no matter the cause, figuring out a way to help prevent them should be given more attention.

Turbine fire illuminates need for reporting mandate

The Jan. 16 blaze that destroyed the gearbox and electrical components behind the blade of a Kibby Mountain turbine is the first reported case of a turbine fire at a wind farm in Maine, according to the Maine Department of Environmental Protection. Speculation about its cause and the possibility that repeat incidents could trigger forest fires is contributing to a heated political debate about wind energy in Maine. Objective, publicly accessible data, not politically motivated guesswork, should drive that debate.

The statutes that allow expedited permitting of grid-scale wind energy projects in Maine do not require notification of fires, but they should. Mainers have a right to know about fires or other potentially hazardous situations at large-scale industrial facilities like wind farms. A simple change to wind farm permitting rules to require that operators report fires at their facilities in a timely manner would help public safety and industry officials compile data that could be used to mitigate future hazards.

A template for such a reporting system exists with the DEP’s current guidelines for public notification of hazardous waste and materials spills. Because the DEP now has permitting authority over wind development, the agency would be an appropriate first point of contact — after emergency responders — that could relay information about the fires to the Maine Forest Service, Maine Emergency Management Agency, State Fire Marshal’s Office or other affected parties.

A fire reporting mandate would also keep the focus on public safety impacts of wind energy generation technology and help puncture the bellows of opponents whose conspiracy theories inflate with notions of a “cover up.”

[Note: As a former Fire Chief, former Town Forest Fire Warden for the Maine Dept of Conservation, Forest Fire service, Windpower Consultant and Power Lineman Transformer Technician, I have a great deal of experience in the industry. There are in fact cover-ups. Maybe the good Editor-in Chief at the BDN should read my last few articles.]

Fiskar and Electric Car Updates

Documents show Obama was warned about Fiskar

Fisker Automotive, the struggling government-backed hybrid sports car maker, on Friday terminated most of its rank-and-file employees in what sources said was a last-ditch effort to conserve cash and stave off a potential bankruptcy filing. Fisker, which raised $1.2 billion from investors and tapped nearly $200 million in government loans, has "at least" $30 million in cash on hand, according to a source familiar with the company's finances.

About 160 workers were fired at a Friday morning meeting at Fisker's Anaheim, California, headquarters, according to a source who attended the meeting. They were told that the company could not afford to give them severance payments. "Unfortunately we have reached a point where a significant reduction in our workforce has become necessary," Fisker said, adding that it was still searching for a strategic partner.

The mass termination triggered a lawsuit seeking class-action status from angry former employees. A lawyer for the fired employees said he expects the company to file for bankruptcy"sooner rather than later."

More on Fiskar

China can't appreciate Obama Biden vision for Fiskar in Delaware

Fiskar allowed to tap US loan after default

Fiskar the new Solyndra, Obama kept pumping taxpayer cash when company was failing

Fiskars departure from Fiskar leaves it without a soul

Fisker Automotive co-founder Henrik Fisker is, by many accounts, an inspired designer with a devoted following –- unabashed ambassadors of the $110,000 hybrid Karma have included Justin Bieber and Leonardo DiCaprio –- but they no longer include his colleagues at the company. Fisker yesterday resigned from the green automaker and made the news public with an email to selected member of the press.

"The main reasons for his resignation are several major disagreements that Henrik Fisker has with the Fisker Automotive executive management on the business strategy," the email stated, according to Reuters’ Deepa Seetharaman, who points out that the departure comes at a “sensitive time.”

“In recent weeks, Fisker management has been looking into selling the company, weighing bids including a $350 million offer from China's Dongfeng Motor Corp., Joseph B. White and Neal E. Boudette report in the Wall Street Journal.

The company has been getting bad press since the Energy Dept. closed the tap on a $529 million loan in 2011 because of missed deadlines. “Fisker had borrowed about $193 million of the total at the time, much of which had been used for design work,” Fred Meier and James R. Healey recount in USA Today. “The rest was to have been spent to develop and build a second, less-expensive vehicle -- the $55,000 Atlantic sedan -- at a refurbished General Motors plant in Delaware. The loss of funding led to layoffs in California and Delaware and essentially put the Atlantic on hold.”

Raj, the non-scientist who runs UN Climate Change Circus Show

Are EV dreams going up in smoke?

Yesterday Mitsubishi Motors issued two critical press releases on safety problems with the lithium-ion battery packs for its electric drive vehicles.

The first press release disclosed the March 21st discovery of a lithium-ion battery pack failure in an Outlander PHEV that was being prepared for delivery to a customer. One of the battery's eighty cells apparently overheated after charging and melted adjacent cells, destroying one of the vehicle's three battery modules. The second press release disclosed a March 18th fire at Mitsubishi's Mizushima plant where a lithium-ion battery pack for an i-MiEV overheated in the battery inspection room and caught fire an hour later.

Electric car maker, Coda, files for bankruptcy

Coda Holdings Inc., parent of the electric-car maker backed by billionaire Philip Falcone, filed for bankruptcy and will seek to sell its assets to a group led by a Fortress Investment Group unit for $25 million. The Los Angeles-based company, whose Coda Automotive unit also sought court protection, listed assets of as much as $50 million and debt of as much as $100 million today in the Chapter 11 filing in Wilmington, Delaware. The company said it intends to sell its assets within 45 days.

Coda was forced to seek bankruptcy protection because of production delays, insufficient capital to market and sell its sedan, and slow growth for the electric-vehicle market, which it blames on the scarcity of charging stations, according to a declaration by Chief Restructuring Officer John P. Madden. Coda will focus on its energy-storage business, Chief Executive Officer Phil Murtaugh said in a statement today.

Sales of the Coda sedan, built off China-based Hafei Motor Co.’s Saibao platform, fell short of expectations, with fewer than 100 units sold since entering the market in March 2012, according to court papers. Complications adapting the sedan to an electric platform and meeting U.S. regulatory standards delayed production until a year after originally anticipated in November 2011.

Closely held Coda, which counted former U.S. Treasury Secretary Henry Paulson as an investor, pitched its vehicle as a “real world” car with better range, battery-pack life and acceleration than competitors.

Analysis: Rethinking the lithium-ion batters over cost, safety

For nearly two years, a team of former Chevrolet Volt and Toyota Prius engineers has been working on the next big thing in electric cars: the latest version of the 154-year-old lead-acid battery. Their aim is to build a battery strong enough to power a wider range of vehicles, something they think the current cutting-edge technology - lithium ion - can't do cheaply, particularly given recent safety scares.

The focus of Energy Power Systems on a technology older than the automobile itself illustrates the difficulty with lithium-ion batteries. While widely used in everything from laptops to electric cars and satellites, a number of high-profile incidents involving smoke and fire have been a reminder of the risks and given them an image problem.

Report: Energy Department mismanaged stimulus backed climate program

The Energy Department’s (DOE) internal watchdog is attacking DOE management of a $1.5-billion stimulus program to help develop technology that captures industrial carbon dioxide emissions. An Office of Inspector General audit made public Tuesday examines $1.1 billion in funding for 15 projects. The audit notes three project recipients together received $90 million even though reviews of the proposals “identified significant financial and/or technical issues.”

“For example, the Department awarded more than $48 million to one recipient whose financial condition precluded it from obtaining a satisfactory merit review score. Rather than addressing the underlying issues, the Department accepted increased risk and lowered the recipient's required cost share,” the IG states.

Maryland Governor signs wind bill

Governor Martin O’Malley signs the wind energy bill.

Maryland Governor's brother-in-law pushing wind power

This was brought to my attention by DB regular Skinflint.

RECENT GREEN CHRONICLES

Why Wind Power Won't Work

The Mafia Is Moving Into Green Energy

Deutsche Bank Raided In Carbon Tax Fraud

John Kerry Comes Out Swinging On Climate Change