Editor's note: The charts and graphs did not translate correctly. Visit the 'source' link provided below to see them in full detail.

##

By Russ Winter

In its first quarter 2010 Household Assets and Liabilities Report (H4), the Fed says residential real estate (RRE) in the US is valued at about $16.5 billion. The debt taken on to finance this asset totals $10.25 trillion. On its face, the remaining $6.25 trillion in equity would seem to be adequate to dodge bullets. The problem is that an estimated $5.25 trillion is free and clear, leaving a nasty ”have not” contingent to support the $10.25 trillion with only one trillion in equity. And now prices are moving lower than what was stated in the Fed report, perhaps wiping out all of the remaining $1 trillion.

Unfortunately, during the Gumnut-induced “recovery” these mortgages in aggregate have been only marginally deleveraged or reduced. In fact, among the “have nots” it has been increased and worsened. New buyers are supported by low payments, low interest, easy terms, and tax incentives from Gumnut. Essentially, the diciest aspects of the subprime and Alt A travesties have been replaced by dicey mortgages backed or owned by Gumnut agencies.

The FHA allows not-so-qualified buyers to squat with 3.5% down payment terms. As of June 2010, the FHA had 6.4 million insured loans in force. Three and a half million of them were put in place during FY 2008-2009. This was roughly a fourth of the mortgage market during that period. The total dollar amount of FHA insurance in place through June was $865 billion. Bank of America and Wells Fargo are invoking their “skill sets” to lead the charge on this fiasco.

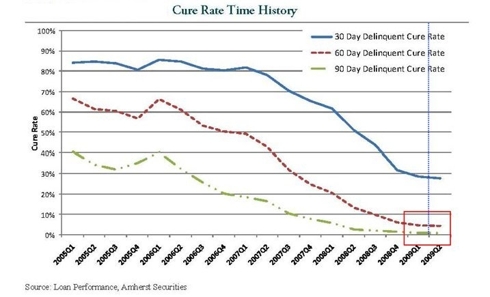

As you can see from the first chart, 40 to 45% of FHA activity in 2007 and in the first half of 2008 were to borrowers with FICO scores below 620 (the definition of subprime). Incredibly, the FHA Commissioner recently admitted that they made 360,000 loans to Gente with FICO scores of 500 or lower. Of them, 37% are now delinquent or in bankruptcy. The performance of FHA lending during their subprime “experiment” shows in spades. In the second chart, we see these mortgages rarely cure once they become delinquent.

![[FHA]](http://sg.wsj.net/public/resources/images/NA-BG316_FHA_NS_20100606195626.gif)

Stung by its role as the defacto subprime lender in this period, FHA slowly began to tighten its lending standards. Finally, in late 2009, FHA was largely out of subprime lending and instead committed itself to promoting squatting by allowing prolonged stays (Ministry of Truth euphemism is “mitigation” and “‘modification”) by its large portfolio of delinquent clients.

In this effort, the FHA also assisted 450,000 families in keeping their homes out of foreclosure in FY 2009. For the first quarter of the current fiscal year, the agency assisted another 122,000 families. Unfortunately, the Mortgage Metrics Report issued jointly by the Office of Comptroller of the Currency (OCC) and the Office of Thrift Supervision (OTS) for the first quarter of 2010 revealed that 67% of these modified FHA mortgages were in default again within 12 months. Despite of these increasing mortgage modification efforts, the number of seriously delinquent FHA mortgages (delinquent 90+ days) climbed to 555,000 in May 2010, according to HUD’s Neighborhood Watch database.

This should demonstrate to thinking people just how much misery these programs cause. FHA is clearly nothing more than a Gumnut- sponsored squatter program (partnered with Too Big to Fail Banks) with huge “unfinished” business on its hands. A glance at REO inventory should demonstrate that FHA doesn’t really bother to foreclose or do much of anything with its debtors. This approach promises to add huge costs to the Treasury to go along with the sufferings of the people it intends to “help.”

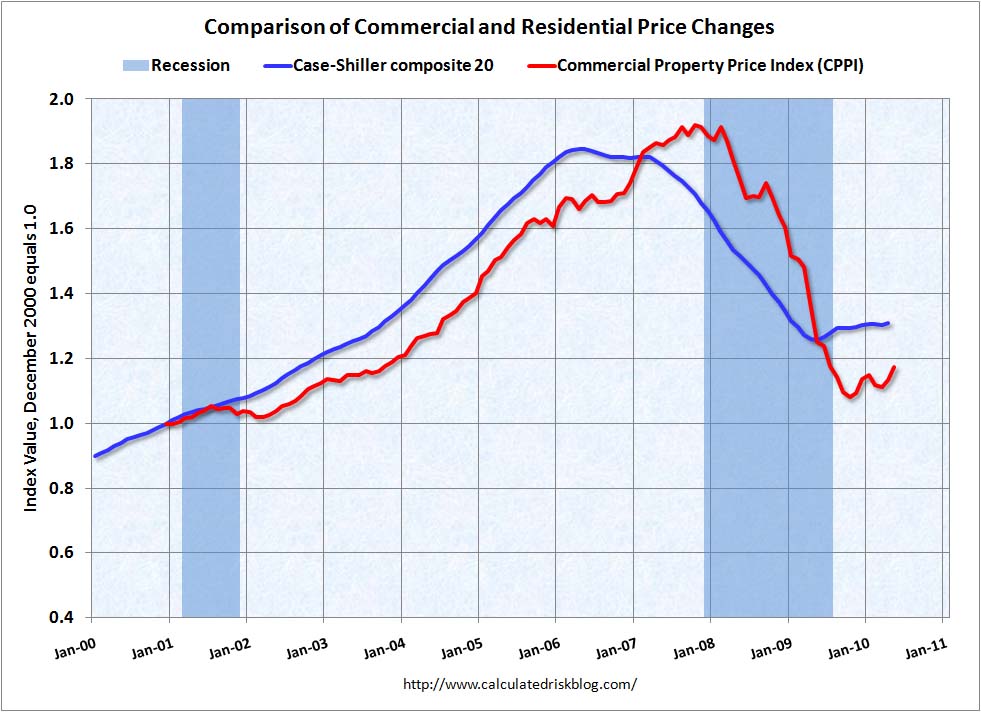

The Gumnut has gambled that they could create an artificial ”supportive bid” for housing using this agency, and they have clearly lost. Next, the Gumnut gambles that they could support housing (and by extension the economy) by promoting squatting. This gamble has also been lost. If you undertake the same exercise here, as we did earlier with CRE, we see virtually all these dicey mortgages are well underwater. The 2008 vintage is now 10-25% underwater. The 2009 vintage is flat. Now there is evidence that RRE is turning down. Not that being flat or 30% underwater really matters with these mortgages, as now it’s all about calculating the ultimate hit the Gumnut will take.

Like so much else, FHA’s daisy chain reserve backing is really nonexistent, and accounting is in slow motion and opaque. The last smoke screen, I mean audit (giving a poor outcome) was released last November. Any disclosure this agency makes about its capital reserve is meaningless given their total commitment to promoting squatters and pretending. Meanwhile, watching this unfold is like witnessing a train wreck before our very eyes.

This sample article is reprinted in its entirety from Russ's premium service, Russ Winter's Actionable. Learn more about Russ Winter's Actionable, and get instant access.

Click here to access Russ Winter's Actionable