Monday

Sep262011

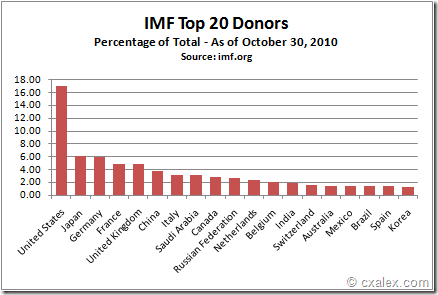

CHART: Who Funds The IMF?

The correct answer is... you. This chart explains in simple terms why you often hear that U.S. taxpayers are bailing out foreign nations - because we provide approximately 17% of IMF funds.

UPDATE - Read this bit of IMF madness:

---

Meanwhile, the IMF makes no secret of their desire to abandon the dollar and create their own world reserve currency.

Sep 26, 2011 at 11:00 AM

Sep 26, 2011 at 11:00 AM

Reader Comments (26)

If Ireland were to default, we could see pensions and savings wiped out -- and mortgage bills at sky-high levels, says Louise McBride

http://www.independent.ie/business/personal-finance/what-would-happen-to-your-money-if-ireland-defaulted-2647568.html

http://www.zerohedge.com/article/obama-corporate-taxes-%E2%80%93-%E2%80%9Cwhatever-ge-wants%E2%80%9D

http://thinkprogress.org/2011/05/12/drilling-oily-judges/

http://www.marketwatch.com/story/hedge-fund-managers-ponder-armageddon-2011-05-12

IMF head’s arraignment delayed

SYDNEY (MarketWatch) — One of the key players working to address the European debt crisis — International Monetary Fund chief Dominique Strauss-Kahn — remained in police custody late Sunday following a delay in his criminal-court arraignment until Monday, according to reports.

http://www.marketwatch.com/story/imf-head-reportedly-still-in-police-custody-2011-05-16?link=MW_story_latest_news

Heck, we should abandor IMF anyway.

http://www.commondreams.org/view/2011/05/17-15

....What really got my attention in the article was this...

[snip]

Just as long as they don't have to be charged with wrongdoing.

They'll pay the money – which they have a lot of.

But don't mess with their “reputation” by charging them with federal wrongdoing.

They want to find safe harbors where they can't be charged.

And corporate controlled Washington, D.C. is their safe harbor of choice.

And what did Tenaris get from the SEC today?

The first ever deferred prosecution agreement from the SEC.

Under a new SEC program, a company that cooperates with the SEC has a chance of getting one of these sweetheart deals.

Under the agreement, the SEC will refrain from prosecuting the company in a civil action for its violations if Tenaris complies with certain undertakings.

The new SEC program?

http://sec.gov/news/press/2010/2010-6.htm

http://www.informationclearinghouse.info/article28103.htm

By Mike Whitney

May 15, 2011 "Information Clearing House" --- I have no way of knowing whether the 32-year-old maid who claims she was attacked and forced to perform oral sex on IMF chief Dominique Strauss-Kahn, is telling the truth or not. I'll leave that to the braying hounds in the media who have already assumed the role of judge, jury and Lord High Executioner. But I will say, the whole matter smells rather fishy, just like the Eliot Spitzer story smelled fishy. Spitzer, you may recall, was Wall Street's biggest adversary and a likely candidate to head the SEC, a position at which he would have excelled. In fact, there's no doubt in my mind that if Spitzer had been appointed to lead the SEC, most of the top investment bankers on Wall Street would presently be making license plates and rope-soled shoes at the federal penitentiary. So, there was plenty of reason to shadow Spitzer's every move and see what bit of dirt could be dug up on him. As it turns out, the ex-Governor of New York made it easy for his enemies by engaging a high-priced hooker named Ashley Dupre for sex at the Mayflower Hotel. When the news broke, the media descended on Spitzer like a swarm of locusts poring over every salacious detail with the ebullient fervor of a randy 6th-grader. Meanwhile, the crooks on Wall Street were able to breathe a sigh of relief and get back to doing what they do best; fleecing investors and cheating people out of the life savings.

Strauss-Kahn had enemies in high places, too, which is why this whole matter stinks to high-Heaven. First of all, Strauss-Kahn was the likely candidate of the French Socialist Party who would have faced Sarkozy in the upcoming presidential elections. The IMF chief clearly had a leg-up on Sarkozy who has been battered by a number of personal scandals and plunging approval ratings.

But if Strauss-Kahn was set up, then it was probably by members of the western bank coalition, that shadowy group of self-serving swine whose policies have kept the greater body of humanity in varying state of poverty and desperation for the last two centuries. Strauss-Kahn had recently broke-free from the "party line" and was changing the direction of the IMF. His road to Damascus conversion was championed by progressive economist Joesph Stiglitz in a recent article titled "The IMF's Switch in Time". Here's an excerpt:

"The annual spring meeting of the International Monetary Fund was notable in marking the Fund’s effort to distance itself from its own long-standing tenets on capital controls and labor-market flexibility. It appears that a new IMF has gradually, and cautiously, emerged under the leadership of Dominique Strauss-Kahn.

Slightly more than 13 years earlier, at the IMF’s Hong Kong meeting in 1997, the Fund had attempted to amend its charter in order to gain more leeway to push countries towards capital-market liberalization. The timing could not have been worse: the East Asia crisis was just brewing – a crisis that was largely the result of capital-market liberalization in a region that, given its high savings rate, had no need for it.

That push had been advocated by Western financial markets – and the Western finance ministries that serve them so loyally. Financial deregulation in the United States was a prime cause of the global crisis that erupted in 2008, and financial and capital-market liberalization elsewhere helped spread that “made in the USA” trauma around the world....The crisis showed that free and unfettered markets are neither efficient nor stable." ("The IMF's Switch in Time", Joseph Stiglitz, Project Syndicate)

So, Strauss-Kahn was trying to move the bank in a more positive direction, a direction that didn't require that countries leave their economies open to the ravages of foreign capital that moves in swiftly--pushing up prices and creating bubbles--and departs just as fast, leaving behind the scourge of high unemployment, plunging demand, hobbled industries, and deep recession.

Strauss-Kahn had set out on a "kinder and gentler" path, one that would not force foreign leaders to privatize their state-owned industries or crush their labor unions. Naturally, his actions were not warmly received by the bankers and corporatists who look to the IMF to provide legitimacy to their ongoing plunder of the rest of the world. These are the people who think that the current policies are "just fine" because they produce the results they're looking for, which is bigger profits for themselves and deeper poverty for everyone else.

Here's Stiglitz again, this time imparting the "kiss of death" to his friend Strauss-Kahn:

"Strauss-Kahn is proving himself a sagacious leader of the IMF.... As Strauss-Kahn concluded in his speech to the Brookings Institution shortly before the Fund’s recent meeting: “Ultimately, employment and equity are building blocks of economic stability and prosperity, of political stability and peace. This goes to the heart of the IMF’s mandate. It must be placed at the heart of the policy agenda.”

Right. So, now the IMF is going to be an agent for the redistribution of wealth.... (for) "strengthening collective bargaining, restructuring mortgages, restructuring tax and spending policies to stimulate the economy now through long-term investments, and implementing social policies that ensure opportunity for all"? (according to Stiglitz)

Good luck with that.

Can you imagine how much this kind of talk pisses off the Big Money guys? How long do you think they'd put up with this claptrap before they decided that Strauss-Kahn needed to take a permanent vacation?

Not long, I'd wager.

Check this out from World Campaign and judge for yourself whether Strauss-Kahn had become a "liability" that had to be eliminated so the business of extracting wealth from the poorest people on earth could continue apace:

"For decades, the International Monetary Fund (IMF) has been associated among anti-poverty, hunger and development activists as the poster child of everything wrong with the rich world's fiscal management of the rest of the world, particularly of poor nations, with its seemingly one-dimensional focus on belt-tightening fiscal policies as the price of its loans, and a trickle-down economic philosophy that has helped traditional wealthy elites maintain the status quo while the majority stayed poor and powerless. With a world increasingly in revolution because of such realities, and after the global financial crisis in the wake of regulatory and other policies that had worked after the Great Depression being largely abandoned, IMF managing director Dominique Strauss-Kahn has made nothing less than stunning observations about how the IMF and the world need to change policies.

In an article today in the Washington Post, Howard Schneider writes that after the 2008 crash led toward regulation again of financial companies and government involvement in the economy, for Strauss-Khan "the job is only half done, as he has been leading the fund through a fundamental rethinking of its economic theory. In recent remarks, he has provided a broad summary of the conclusions: State regulation of markets needs to be more extensive; global policies need to create a more even distribution of income; central banks need to do more to prevent lending and asset prices from expanding too fast. 'The pendulum will swing from the market to the state,' Strauss-Kahn said in an address at George Washington University last week. 'Globalization has delivered a lot . . . but it also has a dark side, a large and growing chasm between the rich and the poor. Clearly we need a new form of globalization' to prevent the 'invisible hand' of loosely regulated markets from becoming 'an invisible fist.'" (Link---http://wcampaign.org/issue.php?mid=625&v=y)

Repeat: "...a fundamental rethinking of economic theory".... (a greater) "distribution of income"...(more) "regulation of financial companies", "central banks need to do more to prevent lending and asset prices from expanding too fast".

Are you kidding me? Read that passage again and I think you'll agree with me that Strauss-Kahn had signed his own death warrant.

There's not going to be any revolution at the IMF. That's baloney. The institution was created with the clear intention of ripping people off and it's done an impressive job in that regard. There's not going to be any change of policy either. Why would there be? Have the bankers and corporate bilge-rats suddenly grown a conscience and decided to lend a helping hand to long-suffering humanity? Get real.

Strauss-Kahn broke ranks and ventured into no man's land. That's why he was set up and then crushed like a bug.

(Note: Strauss-Kahn has been replaced by the IMF's number 2 guy, John Lipsky, former Vice Chairman of the JPMorgan Investment Bank. How's that for "change you can believe in"?)

http://www.blacklistednews.com/Strauss-Kahn_%26_The_IMFBCCI_Mugger/13966/0/0/0/Y/M.html

[snip]

No case illustrates this type of IMF official mugging better than that of the mysterious Bank of Credit & Commerce International (BCCI).

Robin Hood in Reverse........

..........BCCI – launched by Bank of America – was a CIA drug money laundry which moonlighted as mugger for the IMF bankers. The IMF helped BCCI set up shop in numerous countries, including virtually every Latin American nation. BCCI loaned the Jamaican government money to pay the IMF in return for Jamaican government deposits at BCCI. Bolivia got BCCI loans under the same agreement, this time at the urging of the World Bank. In Peru, the IMF/World Bank solicited Peruvian treasury deposits for BCCI.

None of these countries would ever see the over $1 billion in treasury funds which they collectively put down the BCCI black hole.

http://www.reuters.com/article/2011/05/21/us-strausskahn-advisers-idUSTRE74J78320110521

The Extended Confessions Of An Economic Hit Man

http://www.zerohedge.com/article/extended-confessions-economic-hit-man

At 18/05/2011 and no only 20 country, but 20 and 187 country. Thanks.

Grazie Attilio. Ciò è grandi informazioni ed il vostro blog certamente aggiunge una voce stata necessaria. Le credenziali di Ypur sono favolose e sono felice di fare la vostra conoscenza.

http://attiliofolliero.blogspot.com/2011/02/verso-il-tramonto-del-dollaro-anche.html

Verba volanta, scripta manente

What is the FMI? Why USA is the first economic country?

http://attiliofolliero.blogspot.com/2011/05/dominique-strauss-kahn-il-fondo.html

Is near the end Dollar, of USA, of west power.

The end is near.

Americans and people of Europe to wake up!

Verso il tramonto del dollaro: anche Dominique Strauss-Kahn, segretario del FMI, chiede l’abbandono del dollaro

Attilio Folliero, Caracas, 12/02/2011

Dalla fine della seconda guerra mondiale il dollaro, la moneta degli Stati Uniti, è l’unica moneta di riferimento per gli scambi internazionali. Gli USA sono riusciti ad affermare il loro potere economico a livello mondiale anche grazie al fatto che la loro moneta è l’unica utilizzata per gli scambi commerciali mondiali; in particolare, è utilizzata per la comprevendita del petrolio Tutti i paesi del mondo per poter effettuare intercambi commerciali debbono comprare dollari, ovvero accumulare riserve internazionali in dollari.

Gli Stati Uniti, oggi, sono un paese in profonda crisi económica con un debito pubblico enorme equivalente praticamente al 100% del PIL. Il debito pubblico USA continua ad aumentare incessantemente, perchè di fatto spendono più di quanto incassano. Como coprono questo deficit? Circa un terzo è finanziato dalle banche centrali di Cina, Giappone, Regno Unito e di tutti gli altri paesi del mondo. Il restante 70% è finanziato dalla Federal Reserve, sotto forma di acquisto dei titoli del debito pubblico del Tesoro USA. In sostanza la Federal reserve sta stampando dollari ed il mercato mondiale è sempre più inondato di dollari, cosa che mina il suo valore. Per la legge economica della domanda e dell’offerta, quando l’offerta di un bene è superiore alla domanda il valore di quel bene tende a cadere. Ciò vale anche per il valore di una moneta. Malgrado ciò il valore del dollaro non è crollato; non si tratta di una eccezione alla legge economica suddetta e ciò è dovuto semplicemente al fatto che il dollaro continua ad essere praticamente l’unica moneta utilizzata per gli scambi commerciali a livello mondiale.

Inoltre, tutti i paesi del mondo hanno ingenti quantità di dollari nelle loro riserve, in particolare la Cina che conta con oltre 2.500 miliardi, per cui tutti stanno cercando di frenare la caduta del dollaro, perchè il girono che ciò accadesse le loro riserve varrebbero carta straccia. Da anni, la Cina ed altri paesi che hanno grandi riserve, stanno chiedendo agli USA di cambiare política, al fine di preservare il valore del dollaro e quindi delle loro riserve.

Molti, da anni avvertono che prima o poi il dollaro crollerà. Spesso, anche noi abbiamo trattato il tema, avvertendo che il tracollo del dollaro sembra inevitabile ed ormai è solo questione di tempo (Vedasi: articoli “Il destino del dollaro” e “Nuove monete” e le interviste).

Oggi c’è una grandissima novità su questo tema. Il segretario generale del Fondo Monetario Internazionale (FMI), Dominique Strauss-Kahn, in un recente incontro a Washington ha apertamente parlato della necessità di abbandonare il dollaro ed ausipica la sua sostituzione con un paniere di monete da utilizzare negli scambi internazionali. L’unica via, secondo Dominique Strauss-Kahn, per calmare la crisi che viviamo è abbandonare il dollaro. Orbene questa notizia passata sostanzialmente innavertita dai grandi media, con l’eccezione del Guardian di Londra è di una importanza eccezionale. Il FMI, organismo voluto dagli USA e da sempre a totale disposizione del capitale statunitense, oggi sembra cambiare rotta, sembra voltare le spalle al padrone!

Abbandonare il dollaro, come moneta di riferimento mondiale, significa l’inevitabile tracollo degli USA. Le riserve internazionali degli Stati ammontano a migliaia di miliardi di dollari; solamente le banche centrali dei pincipali venti paesi del mondo hanno riserve per circa 10.000 miliardi, la stragrande maggioranza ovviamente in dollari. Che succede se il dollaro smette di essere la moneta di riferimento? Ossia, perchè diciamo che il giorno in cui il dollaro smette di essere la moneta di riferimento è la fine per gli USA? Nel momento in cui il dollaro cesserà di essere la moneta di riserva mondiale, tutti gli stati saranno costretti a vendere i loro dollari ed acquistare la nuova moneta, che potrebbe essere anche più di una, ovvero un paniere di monete. L’immissione sul mercato di migliaia di miliardi di dollari farebbe crollare immediatamente il suo valore. Noi pensiamo che questo succederà sicuramente; è solo questione di tempo!

Quando questo succederà il riflesso sull’economia USA sarà inevitabile e disastroso. La svalutazione del dollaro sarà cosi grande che trascinerà l’economia USA in uno stato di iperinflazione.

Nella storia i casi di iperinflazione sono tanti, dall’antica Grecia, passando per l’impero Romano, alla rivoluzione francese. Nell’ultimo secolo i casi di iperinflazione sono tantissimi, partendo dalla Germania, della Repubblica di Weimar del primo dopoguerra, dove esattamente nel noviembre del 1923 un dollaro arrivò a valere 4.200 miliardi di marchi. Nell’Ungheria del 1946 si arrivò ad emettere una banconota con 20 zeri (lo százmillió B-pengo che valeva 100 000 000 000 000 000 000 di pengo). Negli ultimi trent’anni numerosi paesi dell’America latina hanno vissuto casi di iperinflazione, dalla Bolivia, al Brasile, all’Argentina.

E’ necesario ricordare anche i casi dell’iperinflazione della Russia nel 1991, della jugisolavia tra il 1992 ed il 1994. L’ultimo paese colpito da iperinflazione è stato lo Zimbabwe, che nel 2008 ha dovuto emettere una banconota da 100.000 miliardi di dollari dello Zimbabwe.

Banconota dello Zimbabwe da 100.000.000.000.000 miliardi di dollari dello Zimbabwe

Un caso di iperinflazione si è verificato anche negli Stati Uniti, nel 1790, dopo la rivoluzione americana, quando la moneta locale, il dollaro continentale, venne stampato senza alcun controllo.

Negli ultimi anni, molte voci si sono alzate contro il dollaro, ma tutti hanno fatto una brutta fine; con una scusa o un’altra sono stati liquidati. Basta pensare a Saddam Hussein, che propose all’Opec di abbandonare l’utilizzo del dollaro per la compravendita del petrolio. Saddam Hussein va oltre: non solo inizia ad accettare altre monete per la compravendita del suo petrolio, ma trasferisce in euro tutte le sue riserve. Tutti sappiamo la fine che ha fatto Saddam Hussein ed il suo paese, l’Iraq, che si è ritrovato occupato dalle truppe statunitesi. Scusa ufficiale per l’invasione: il possesso di armi di distruzione di massa da parte di Saddam Hussein, armi che non furono mai trovate.

Per molti la causa dell’invasione era da ricercare nella necessità degli USA di appropriarsi del petrolio iraqueno. Noi abbiamo sempre pensato che il motivo fosse un altro, come abbiamo scritto: Saddam Hussein aveva deciso di abbandonare il dollaro per la compravendita del petrolio iraqueno e stava trascinando nel suo progetto altri paesi Opec. Ciò avrebbe determinato il tracollo del dollaro e quindi degli USA (Vedasi nostro articolo: “Il dollaro, l'euro, il petrolio e l'invasione nordamericana”).

In Venezuela, il presidente Chávez abbracciò l’idea di Saddam Hussein di sostituire il dollaro e per poco non si ritrovò vittima di due colpi di stato. Riuscì a rimanere al potere, ma dovette fare marciare indietro sul suo progetto di abbandonare il dollaro e di fatto la sua più importante creatura a livello internazionale, il Banco del Sud, sta nascendo ma avendo come moneta di riferimento il dollaro.

La notizia di oggi è l’esternazione del segretario generale del FMI, Dominique Strauss-Kahn, il quale in un incontro a Washington ha detto quello che molti pensano, ma non osano pronunciare: è necesario abbandonare il dollaro!

La noticia, con l’eccezione del Guardian di Londra, ovviamente non trova spazio nei media ufficiali, controllati dal capitale USA. E’ alquanto strano che il segretario del FMI arrivi a pronunciare tali parole. Come mai? Che cosa c’è dietro? Tre sono le ipotesi plausibili: la prima è che dietro tale affermazione ci siano gli stessi Stati Uniti e quindi prenderebbe peso l’ipotesi che gli USA abbiano intenzione di sostituire il dollaro con una nuova moneta, l’amero, di cui tanto si è parlato in Internet (vedasi nostro articolo: “Il destino del dollaro”); la seconda ipotesi è che l’FMI diretta dal francese Dominique Strauss-Kahn è ormai sfuggiata al controllo degli USA e si stia schierando con i nuovi capitalismi in ascesa; la terza ipotesi è che ci troviamo di fronte ad una persona che esprime una libera opinione sulla realtà esistente. Tra l’altro, Strauss-Kahn in questo incontro ha aggiunto che è necessario agire con urgenza perchè i conflitti all’interno del sistema finanziario mondiale potrebbero portare al caos nel mondo.

In ogni caso se la ragione di queste sue affermazioni fosse da ricercare in una delle ultime due ipotesi, è facile aspettarsi una reazione da parte degli USA, potenza in decandenza che non accetterà facilmente di farsi da parte. Gli Usa, in questo momento sono come le bestie ferite che lottano disperatamente fino alla fine. Dominique Strauss-Kahn, uno degli uomini più potenti del mondo, con questa sua esternazione potrebbe essersi giocato il suo futuro.

All by design, third world paradise here we come.

Stop speaking in tongues . I barely understand the English language.LMAO