Not So Well Known - Tracking The Fed's OTHER Criminal Debt Monetization Program

The program in question isn't talked about frequently. It is a completely separate criminal approach to monetizing the national debt through Treasury purchases.

Background reading:

---

NEW YORK (Source - Reuters) - The recent spike in U.S. Treasury yields could whittle down prepayments on the Federal Reserve's $1 trillion mortgage investments and reduce the cash it reinvests into federal government debt.

The Fed's reinvestment of proceeds from maturing mortgage securities, which began in August, was aimed at maintaining its ultra-loose monetary policy. It is a separate move from its controversial $600 billion Treasuries purchase program, dubbed QE2, which started three months later.

The Federal Reserve Bank of New York said in November that reinvestments were expected to total $250 billion to $300 billion by the end of the second quarter of 2011. However, a slowdown in mortgage prepayments due to the surge in home loan rates could pare the Fed's reinvestment into Treasuries from mortgage assets by as much as $100 billion, said Eric Green, chief of U.S. rates research and strategy at TD Securities in New York.

Barclays Capital analysts see a similar slowdown in the wake of the current bond sell-off, downgrading annual paydowns on the Fed's mortgage holdings to about $175 billion from their earlier forecast of $278 billion. This means $8 billion to $9 billion less monthly reinvestment by the Fed.

Last week, the contract rate on U.S. 30-year mortgages, excluding points and fees, averaged at 4.66 percent, the highest since late July, the Mortgage Bankers Association said on Wednesday. The average 30-year loan rate has risen 0.38 percentage points from a month earlier. The MBA's mortgage activity index, meanwhile, fell 28 percent in the week ended Dec 3 from a month earlier.

The 10-year Treasury yield, which is the benchmark for the 30-year mortgage rate, has risen about three-quarters of a percentage point over the last month and hit a six-month peak of 3.29 percent on Wednesday.

Compounding the market sell-off this week was a proposed deal between Democratic U.S. President Barack Obama and Republican lawmakers to extend Bush-era tax cuts and to reduce payroll taxes.

The Fed's initial bout of bond buying that began in mid-November comprised $75 billion for QE2 and $30 billion for its mortgage reinvestment program.

Continue reading at Reuters...

##

More on this from Bloomberg...

The Fed has bought $106.3 billion in Treasuries on its way to purchasing $600 billion of government debt through June 2011. Separately, it has purchased $75.8 billion of Treasuries as part of its plan, announced in August, to reinvest maturing mortgage holdings. The second round of unconventional monetary easing is aimed at spurring economic growth and preventing inflation from falling too low.

---

Alternate Treasury Purchases Increase by Fed

Two of the 16 securities the Fed purchased today carried a interest-rate coupon of over 10 percent, including a 10.625 percent note maturing Aug. 15, 2015, and one with a 11.25 percent coupon that comes due on Fed. 15, 2015.

- “Some of the securities the Fed purchased have been floating around for a long time,” added McCarthy. “Whoever owned them made a massive profit.”

- http://www.bloomberg.com/news/2010-11-12/fed-buys-7-229-billion-of-treasuries-as-easing-resumes.html

Jan 4, 2011 at 10:08 PM

Jan 4, 2011 at 10:08 PM

Reader Comments (19)

http://www.reuters.com/article/idUSTRE6BC23E20101213

http://blogs.reuters.com/prism-money/2010/12/06/it-takes-two-to-tango-in-the-subprime-mess/

http://www.thenation.com/blog/156973/treasury-blocks-legal-aid-homeowners-facing-foreclosure

http://www.businessweek.com/news/2010-12-09/fed-assets-reach-record-2-39-trillion-on-purchases-of-bonds.html

http://www.bloomberg.com/news/2010-11-12/fed-buys-7-229-billion-of-treasuries-as-easing-resumes.html

Read more: http://www.foxbusiness.com/markets/2010/12/13/judge-rejects-key-obama-health-care-law/#ixzz181EvO3M1

Vatican Bank 'allowed clergy to act as front for Mafia'

That's how Dr. David Keanu Sai, a retired Army Captain with a PhD in political science and instructor at Kapiolani Community College in Hawaii, characterizes Hawaii's international legal status. Since 1993, Sai has been researching the history of the Kingdom of Hawaii and its complicated relationship to the United States.

http://www.truth-out.org/sai-v-obama-et-al-hawaiis-legal-case-against-united-states65850

LONDON (MarketWatch) -- The European Central Bank stepped up its government bond purchases to 2.667 billion euros ($3.56 billion)in the week ended Dec.10 after settling 1.965 billion euros the previous week. The ECB on Dec. 2 promised to keep its bond-purchasing program active in an an effort to calm markets nervous about European governments' ability to reduce their budget deficit. The ECB on Monday said it has bought a total of 72 billion euros in government bonds since May.

Now ask yourself this question: How is it that the government that irresponsible can borrow at 3% for ten years?

It can't. Don't waste any time trying to prove it. Such an entity is unworthy of credit at ANY interest rate, period. You know this, too. Simply put, the United States runs a fraud-based economy.

Plan accordingly.

1) We got free money for the primary dealers, who take down about half of all Treasuries.

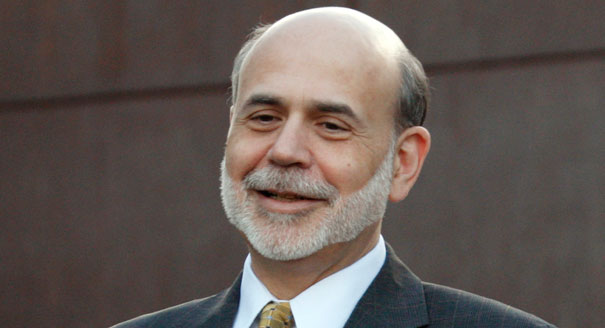

2) In one of your Grayson clips, Bernanke says "We do currency swaps with them and it keeps interest rates down," or something similiar. Grayson wants to know what foriegn banks got the money, but never asks, "Whoa - how does that keep rates low?" The only possible answer is the Fed has setup "You buy my dead cow, and I'll buy your dead horse" arrangements with banks around the world.

3) POMO. As if those operations weren't enough, the Fed will buy Treasuries back too.

You may remember, I wrote an article asking the question "Who's buying this crap?" The only answer I can up with is NOBODY!!! I sent a letter to Geithner asking him to explain certain aspects of the Treasury auctions. I got no reply.

I'm not going to spend any more time trying to prove it, but there is absolutely, positively, no doubt in my mind that the US Treasury auctions are 100% unadulterated FRAUD and they've killed the bond vigilantes.

The Silver vigilantes are the only vigilantes left.

When you hear people proclaim, "yeah, but people are still buying our debt...." it's because Ben's giving away free, newly printed money under the table - in addition to all the money printing we already know about. There's no other answer that makes any sense whatsoever.

I also believe we're getting farther away from discovering the truth, not closer to it. I'm sure you'll see RP's appearance on the Colbert Report....he does an OK job, but the opponent (some douche) makes the statement "people still buy our debt," and RP lets it slide. If RP wants my vote, he's gotta start calling out the fraud that is the US Treasury auction. As it stands right now, he's either afraid to throw the bullshit flag, or he doesn't understand the greatest fraud in history....not qualities I'm looking for in a leader.

I don't get it. Where's the austerity? The primaries are making plenty defrauding Greece and Ireland, why don't the FED and DoT give us a break - cut the Primaries out of their little ponzi circle jerk for a while(?) - it's not like we're going to arrest them all (just yet).

You forgot to mention that the money used to "purchase" those treasuries was "borrowed" from the Fed at zero interest.

So let's review:

1) Fed prints "zero interest" money for PD's

2) PD's go buy treasuries to collect interest from tax payers

3) Fed prints more money to buy the Treasuries from PDs

I'm sure this will end well.....

II agree. Thanks.

Yesterday DB ran a piece titled "Will will buythe FED's MBS"

Assuming the MBS that the FED will offer are so the so called toxic assets - with multiple trundled mortgages (on revealed fraud is that many mortgages had their full principal used as the underlying for more than one MBS), there are at least three haircuts.

Understand the MBS were declared toxic because the issuers or resellers could not determine a market value (like a market value can be calculated - BS - market values are determined by transactions - but these low iodine Ive League Madrassa trained Terrorists thought they could just fineese the ruse of a dollar weighted price (not market value) spread to similar yielding treasures (acceptable in a real market - but FASB requires an actual market price). The truth is "no market value" means that no one will buy them hence "toxic asset".

Haircut number 1:

The FED buys toxic MBS at par, or the alleged. principal balance. THe MBS have no value but the FED uses our harvest and pays the full ((alleged) principal balance. Tax payer gets a probable hair cut of 60 cents to the dollar - IOW - the bond is only worth 40 cents on the alleged face value. We pay 120% the actual worth - I guess they think we're retail marks.

Haircut number 2

The Fed, after using our money to pay full price, sells them back to the primaries and dealers at a discount - let's assume the dealers might pay as much as 60 cents for each dollar of the "alleged" principal balance. A 60 cent initial hair cut to taxpayers for TARP acquired toxic fraudulent assets, bringing the total hair cut to 80 cents. Only 20 cents of value for each TARP dollar invested.

Haircut Number 3.

As we all no this year will be a down and out dog for foreclosures. The principal balance of the MBS sold back to the primaries is covered at 80% the "alleged" bond principal. As those foreclosures kick in, and the bonds go belly up, the bond holders 80% per dollar alleged principal, or 80 cents on the dollar, for a bond whose initial toxic value could not be estimated but we can conservatively assume were only worth 40 cents on the dollar. The mob holding the bonds cannot sell them - Credit Unions. Pension funds and School district treasurers can only buy liquid assets. That's not the goal. The primary, who the FED initially paid par for (maybe) 40 cents of toxic junk will get 80% full faith and credit back. They just made 2.80 of of every fraudulent MBS they scammed us for.

Total haircut

The taxpayer is paying 1.80 for (maybe) 40 cents value.

The threat of collapse unless TARP was immediately appropriated was an act of extortion. The fraud, or pig in a poke, is selling the taxpayer MAYBE 40 cents of value for a buck and 80 cents.

These guys should be hanging by their ankles on the spitting tree and their head stones, and their families' headstones, classified by the national park service as pilgrimage urinals. F*ck em - I'm tire of getting it up the kazoo buy a bunch a kiddie fondling bag men selected by a Diebold Machine. F*ck em.

I think you and me are gonna get along just fine....