Taxpayers Are GIVING Big Banks $83 Billion A Year!

"The top five banks -- JPMorgan, Bank of America, Citigroup, Wells Fargo, and Goldman Sachs - - account for $64 billion of the total subsidy, an amount roughly equal to their typical annual profits.

In other words, the banks occupying the commanding heights of the U.S. financial industry -- with almost $9 trillion in assets, more than half the size of the U.S. economy -- would just about break even in the absence of corporate welfare.

In large part, the profits they report are essentially transfers from taxpayers to their shareholders."

---

Banks Are Not Profitable Without Annual Gift

Why Should Taxpayers Give Big Banks $83 Billion A Year?

On television, in interviews and in meetings with investors, executives of the biggest U.S. banks -- notably JPMorgan Chase & Co. Chief Executive Jamie Dimon -- make the case that size is a competitive advantage. It helps them lower costs and vie for customers on an international scale. Limiting it, they warn, would impair profitability and weaken the country’s position in global finance.

So what if we told you that, by our calculations, the largest U.S. banks aren’t really profitable at all? What if the billions of dollars they allegedly earn for their shareholders were almost entirely a gift from U.S. taxpayers?

Granted, it’s a hard concept to swallow. It’s also crucial to understanding why the big banks present such a threat to the global economy.

Let’s start with a bit of background. Banks have a powerful incentive to get big and unwieldy. The larger they are, the more disastrous their failure would be and the more certain they can be of a government bailout in an emergency. The result is an implicit subsidy: The banks that are potentially the most dangerous can borrow at lower rates, because creditors perceive them as too big to fail.

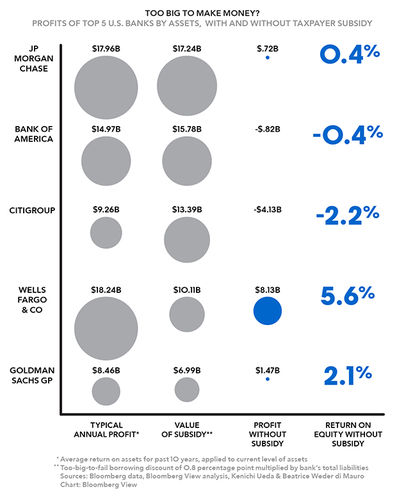

Lately, economists have tried to pin down exactly how much the subsidy lowers big banks’ borrowing costs. In one relatively thorough effort, two researchers -- Kenichi Ueda of the International Monetary Fund and Beatrice Weder di Mauro of the University of Mainz -- put the number at about 0.8 percentage point. The discount applies to all their liabilities, including bonds and customer deposits.

Small as it might sound, 0.8 percentage point makes a big difference. Multiplied by the total liabilities of the 10 largest U.S. banks by assets, it amounts to a taxpayer subsidy of $83 billion a year. To put the figure in perspective, it’s tantamount to the government giving the banks about 3 cents of every tax dollar collected.

The top five banks -- JPMorgan, Bank of America Corp., Citigroup Inc., Wells Fargo & Co. and Goldman Sachs Group Inc. - - account for $64 billion of the total subsidy, an amount roughly equal to their typical annual profits. In other words, the banks occupying the commanding heights of the U.S. financial industry -- with almost $9 trillion in assets, more than half the size of the U.S. economy -- would just about break even in the absence of corporate welfare. In large part, the profits they report are essentially transfers from taxpayers to their shareholders.

Neither bank executives nor shareholders have much incentive to change the situation. On the contrary, the financial industry spends hundreds of millions of dollars every election cycle on campaign donations and lobbying, much of which is aimed at maintaining the subsidy. The result is a bloated financial sector and recurring credit gluts. Left unchecked, the superbanks could ultimately require bailouts that exceed the government’s resources. Picture a meltdown in which the Treasury is helpless to step in as it did in 2008 and 2009.

This graphic shows the enormous size of the subsidy.

Apr 23, 2013 at 3:20 AM

Apr 23, 2013 at 3:20 AM

Reader Comments (15)

A defensive Fed chair is not a good sign. Defensiveness is a sign of weakness and fear in the face of real questions...

RI Special Master Merrill W. Sherman - Former Banker - Corrupts Federal Foreclosure Order

http://www.foreclosurehamlet.org/profiles/blogs/ri-special-master-merrill-w-sherman-former-banker-corrupts-federa

These people are as blinded by their avarice as the Bourbon monarchs once were.

Then again, he hasn't told her to get moving or fired her sorry ass.

Subsidy 3.0

http://www.goodjobsfirst.org/subsidy-tracker